Raising capital for your SaaS startup is commonly a vital step in launching your business and sustaining its operations. You need to be able to meet the initial costs, such as office space, utilities, salaries, equipment & supplies, etc. The good news is that there are different ways to raise capital for your firm, and one of them is venture capital.

The venture capital world is investing even more capital into software-as-a-service (SaaS) companies. In the US alone, $136.5B was invested in SaaS companies in 2019. With SaaS increasingly being applied in almost all areas, revenues in the sector are forecasted to grow by 17%, resulting in an $85 billion market in 2020.

As a SaaS founder, it’s vital to position your firm for funding — one of the ways to do this is to identify your target capital providers. Whether you’re looking for your Seed or A Series round, you should be able to identify investors who will make exceptional partners for your venture.

Today, more investors and accelerators are funding B2B companies in the SaaS industry. So, knowing who to partner with is critical for the growth of your startup. As such, we’ve created this list to help you narrow down your search and find the best funders.

1. Atlanta Ventures

If you’re looking to start a new company, Atlanta Ventures might be a great funder to pitch your idea. Based in Atlanta, Georgia, the company invests in early-stage subscription companies, particularly in the Southeast region. It can lead or fill the entire round with an amount of $250K to $1M.

Atlanta Ventures has invested in some reputable SaaS companies, such as SingleOps, SalesLoft, TeamWorks, and Calendly. Also, they have a studio that is ideal for entrepreneurs interested in launching with the company. In this case, you’ll get free office space, tools, continued support, and connections necessary for a successful and impactful launch.

2. Sequoia Capital

Headquartered in Menlo Park, CA, Sequoia Capital is an American VC form that mostly focuses on technology investments, and it’s one of the largest VC firms. The company prefers partnering early with entrepreneurs, and it has some great companies in its portfolio, including Yahoo!, Google, Dropbox, Alibaba, Stripe, and YouTube.

According to the company, about 75% of its seed-stage companies have secured Series A financing since 2010. Sequoia can lead your next round of funding, or they can help you find a good Series A partner. The firm invests about $1m to over $50m in companies, and it has funded companies that now control over $1.4 trillion of total stock market value.

3. The SaaStr Fund

SaaStr Fund is the brainchild of SaaStr, a company that brings together SaaS entrepreneurs, founders, and executives in one large community. The fund only invests in 4 to 5 start-ups every year, and it invests about $0.1m to $2m per company.

Based in San Francisco, CA, the company helps start-ups build their first management team, find the next-round investor, and promote their products/services. They also mentor and advise startups. However, they only invest in founders that are part of the SaaStr community. It has invested in different companies, including Pipedrive, MaestroQA, Talkdesk, Salessoft, HelloOffice, etc.

4. Andreessen Horowitz

Founded in 2009, Andreessen Horowitz (a16z) is a Silicon Valley VC firm that backs entrepreneurs in technology. The company invests in seed to late-stage companies in different spaces, such as enterprise, crypto, bio/healthcare, and fintech. It’s headquartered in Menlo Park, California.

a16z has around $16.5B in assets under its management. As of 2020, their active portfolio includes companies, such as DoNotPay, Dwolla, Foursquare, HealthIQ, Optimizely, Sandbox, etc. According to the company’s director, a16z is ready to invest anything from a $30 million Series C funding to a $1 billion Series G and beyond. It also launched a $2 billion late-stage venture fund in 2019.

5. Ventech

With its headquarters in Paris, France, Ventech is a global VC fund that invests in tech-driven early-stage companies. It mainly focuses on companies in Europe and China, and it has helped entrepreneurs raise over €400m. In its portfolio, Ventech has companies, such as Capcito, ReachFive, 4stop, Antidot, etc.

The company can invest between €100K and €250K in young, disruptive companies. However, it prefers Series A companies that require an initial investment in the range of €2M and €5M. Its area of interest includes deep technology, enterprise software, media, and marketplaces.

6. Point Nine Capital

This Berlin-based venture capital firm focuses exclusively on early-stage internet companies in areas such as online marketplaces, mobile, and SaaS. Point Nine Capital mainly invests in companies in Europe, the US, and Canada, boasting an investment portfolio of over 191 companies.

They invest between €0.5 and €2.5 million in every company, in addition to participating in the Series A of all companies. Their P9Family includes companies, such as CallDesk, Back, Chainalysis, ChartMogul, EnjoyHQ, etc. As of 2020, they have raised €99,999,999 for these companies.

7. Battery Ventures

As a global, technology-based VC firm, Battery Ventures boasts about 37 years of expertise in the industry. According to its website, the company has invested in more than 300 companies, such as Amplitude, 6Sense, BlueKai, Brightree, Practice Fusion, ProfitLogic, etc.

The company invests in companies at all investment stages, ranging from seed to growth. This can be any amount from $2m to $100m. Battery Ventures is based in Boston, MA, and it has five other global offices, including one in London. It targets companies in different areas, such as consumer mobile/internet, IT infrastructure, and application software.

8. Eight Roads Ventures

Eight Roads Ventures started its operations in Boston in 1969, but today it has offices around the globe in London, Hong Kong, Mumbai, Tokyo, etc. It mainly partners with founders in healthcare and technology, building a global portfolio of over 250 companies. Examples include AppsFlyer, Curam Software, Decibel Insight, Funnel, GoodData, etc.

With an AUM value of $6 billion, the company majorly targets mature companies. In 2018, Eight Roads Ventures Europe launched a $375 million scale-up fund to target companies that needed investments of $10 million to $30 million. It was looking to back about 15 to 20 companies.

9. Scale Venture Partners

Headquartered in Foster City, CA, Scale Venture Partners is a VC firm that focuses on early-in-revenue technology companies in software as a service, cloud computing, internet, and mobile products. Some of the companies in its current portfolio include DemandBase, Bill.com, Aviso, Datastax, Cognata, etc.

The company participates majorly in Series A and B deals, investing about $10 to $15 million in $25 million deals. However, they can go as low as $5 million when making investments. They’re always willing to lead the first go-to-market expansion funding rounds for their partners.

10. 500 Startups

Founded in 2010, 500 Startups is an early-stage VC firm headquartered in Mountain View, California. The company targets entrepreneurs in over 75 countries, and it has invested in over 2,400 companies.

In 2019, the company topped PitchBook’s annual ranking of most active investors globally. The firm has over $535 million in committed capital, and its portfolio has over 15 unicorns. It basically invests $150,000 in companies in exchange for 6% equity. 500 Startups has invested in companies, such as Docket, InnerTrends, Heartex, etc.

11. Northzone

Best known for being an early funder of Spotify, Northzone started in 1996, and it has its headquarters in London, England, with other offices in New York and Stockholm. The firm targets early-stage enterprise and consumer companies in the mobility, education, financial services, and construction sectors.

Northzone focuses primarily on Seed, Series A, and B rounds, and it has made over 150 investments in different countries, such as Spotify, iZette, Trustpilot, Personio, etc. Seed investments are below €1 million, while Series A & B investments range from €1 to 25 million. The company is also open to participating in later funding rounds.

12. Matrix Partners

This US-based VC firm has its headquarters in San Francisco, CA, and it started in 1977. Matrix Partners focuses on seed and early-stage companies in the US, China, and India. It has invested over $4 billion in different companies, such as HubSpot, Lever, Markforged, Namely, Oculus, etc.

Matrix Partners makes investments of $1mn to $10mn in SaaS, healthcare, fintech, and internet companies. Additionally, it also commits follow-on investments over the life of its partners. The company usually targets to be the largest non-management shareholder and first institutional investor in its portfolio companies.

Want to optimise your market spending? 💸

Download this FREE Guide to manage your marketing budget and spend it on strategies that are effective and results-driven.

13. New Enterprise Associates

With its headquarters in Chevy Base, MD, New Enterprise Associates (NEA) is a VC firm that focuses on seed-stage through growth-stage investments. It primarily invests in healthcare and technology companies, and it has over 40 years of experience in the industry.

NEA’s active portfolio features more than 500 companies, including Cloudflare, Workday, Data Domain, Vonage, etc. The firm also boasts more than 230 companies that have IPOs. It invests as low as $1m to over $50 million.

14. Frog Capital

Operating from London, UK, Frog Capital was founded in 2008 with a focus on funding Software Scale-Ups in Europe. It covers two specific areas: Smart Data and Digital Infrastructure. The firm even narrows down to areas where they have in-depth experience and understanding: FinTech, EdTech, Retail, PropTech, and Industry 4.0.

Frog Capital invests €5m to €20m in its portfolio companies, including SHE, OpenSignal, Order Dynamics, Dynamic Action, etc. Bear in mind that the company only works with a select group of software leaders in Europe. Through its Scale-Up methodology, the company defines the critical elements for success for any CEO.

15. Acceleprise

Acceleprise has a different approach compared to most VC firms. Basically, it’s a B2B SaaS accelerator with operations in New York City, San Francisco, and Toronto. It focuses on growing early builders in small cohort sizes, with a maximum of 10 companies per cohort.

Each company in the cohort has access to $100K and a community of over 500 mentors from different SaaS companies. Entrepreneurs have to apply to join the programme. Acceleprise has invested and worked with over 150 early-stage SaaS companies, and it’s leveraging this experience to help new companies.

16. Index Ventures

Boasting a total asset value of €3.7 billion, Index Ventures is a European VC firm that started in Geneva, and it also has operations in London and San Francisco. It was founded in 1996 with the aim of investing in technology-enabled companies, working with them from seed to venture to growth.

Index Ventures focuses on Fintech, media & entertainment, retail, mobile, and software. The firm makes investments ranging from €50k to over €5M. Some of the companies in its portfolio include Confluent, Transcend, Pure Storage, CipherCloud, to name a few.

17. Frontline Ventures

Based in London, Dublin, and San Francisco, Frontline Ventures is a B2B VC form that targets seed ventures in Europe and growth-stage companies in the US. It offers these investments via its two products: Frontline X (US) and Frontline Seed (Europe).

With Frontline X, the company invests up to $5 million in potential companies alongside lead investors. On the other hand, the firm invests €200,000 to €3 million in seed companies through Frontline Seed. Frontline Ventures has over 70 companies in its portfolio, including Qualio, Qstream, Payslip, Lattice, etc.

18. Alchemist Accelerator

Alchemist Accelerator is another VC where you have to apply to join the programme — you should know that there are deadlines. The programme supports over 300 startups, which have received over $1.2 billion from the company. It has operations in San Francisco and Munich.

The programme is about 6-month long, and each class of startups has about 25 teams. Each class gets $36k+ in funding in exchange for 5% of the equity. This programme targets startups in climate tech, digital health, industrial IoT, FinTech, and cybersecurity. Some of the companies in its portfolio are BreachRx, Seventh.ai, Node App, and Veamly.

Looking to expand your business?

Through our FREE Growth Assessment we will analyse your marketing strategy and give you clear recommendations on how you can unlock more growth. 💪

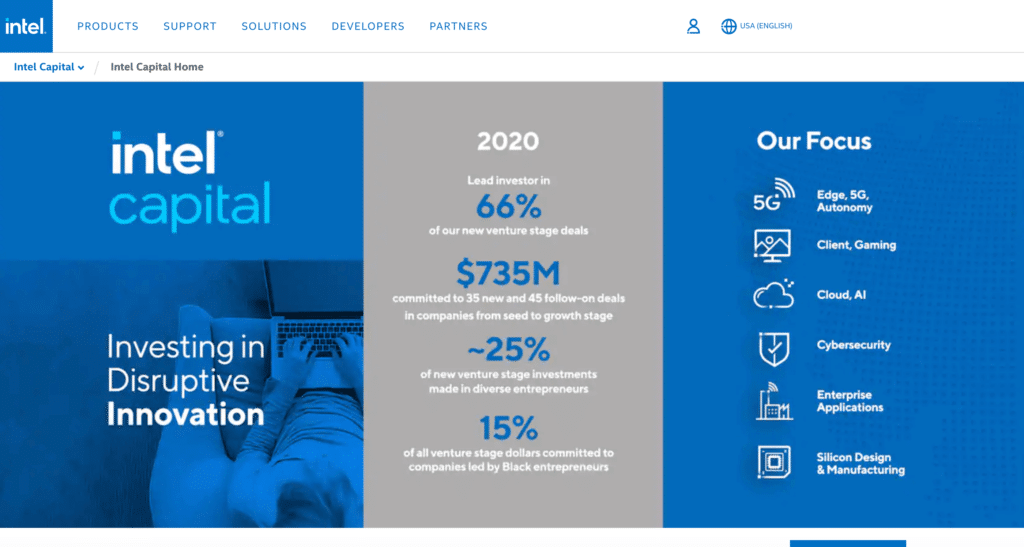

19. Intel Capital

Founded in 1991, Intel Capital is one of the most active VC firms in big data, IoT, AI, and cybersecurity. Since its inception, the company has invested over US$12.9 billion in 1,582 companies around the globe. Of these companies, 692 have IPOs or merged with other companies.

The firm is owned by Intel (a world-renowned technology company), and it has operations in the US and China. It focuses on seed-stage and growth-stage ventures, with investments of $1m to over $10M. The company has invested in startups such as Airship, CognitiveScale, Proprio, Catalytic, EasySend, etc. In 2020, Intel Capital invested $132m in 11 startups.

20. Insight Partners

Another great investment partner is Insight Partners, a New York City-based VC, and private equity firm with an asset value of over $30 billion. The company targets growth-stage internet, software, and technology businesses. It has over 25 years of experience with over 400 investments, which include 45+ IPOs.

Insight Partners has invested in different B2B companies, such as ExactTarget, Shopify, Qualtrics, Veeam, Yext, etc. The company makes investments ranging from $1M to over $10M. It has a scaleup engine known as Onsite that’s key in guiding effective-decision making for their portfolio companies.

21. L-Spark

L-Spark is based in Kanata, Ontario, and it runs an accelerator programme for enterprise SaaS and cloud startups in HealthTech, IoT, and autonomous vehicles. The programme supports over 60 companies, with a follow-on-funding of over $80 million. Each company in the programme receives a custom plan, office space, mentorship, perks programme, etc.

It has four different programmes for different companies, including SaaS Accelerator. MedTech Accelerator. Autonomous Vehicle, and Compass North. Each of these programmes aims to connect startups with experts and help them improve their revenues to $100k MRR. As a startup, you have to apply to join the programmes.

22. Emergence Capital

With a remarkable market cap of over $400 billion (current and former portfolio companies), Emergence Capital started in 2003 by investing in CEOs who shared their belief: Enterprise software should move to the cloud. Today, the firm invests in early and growth-stage cloud and SaaS enterprises.

Emergence Capital has its headquarters in San Mateo, CA, US, and it has an outstanding portfolio that features some of the top companies, such as Zoom, Bill.com, Xapo, Yammer, SalesLoft, Veeva, Salesforce, etc. The firm makes investments of $1m to $15m in its portfolio companies.

23. AngelPad

AngelPad is an American seed-stage incubator based in San Francisco, CA. The firm has raised over $2.2 billion for its companies, with the average funding standing at $14m or more. The programme has supported over 150 companies since its launch in 2010.

Companies must apply to join the programme, which runs for six months. The firm only selects about 15 companies from the pool of applicants. These companies get $120,000 each, in addition to more than $300,000 in cloud credits from Digital Ocean, AWS, and Google. They also get mentorship and access to a huge community of founders and investors. AngelPad has invested in different companies, including Pipedrive, Hive, Beamery, Fieldwire, DroneDeploy, etc.

24. VentureFriends

This early-stage venture capital firm has its base in Marousi, Greece, and it invests in Seed and Series A startups. VentureFriends has a sweet spot for marketplaces, FinTech, SaaS, TravelTech, and PropTech. It also focuses only on companies in Europe, as of 2020.

The company makes investments ranging from €300K to €2.5M, and it has an initial to follow-on investment ratio of 1:2. Its investment portfolio features Belvo, Blend, Project Agora, Pockee, Ad Espresso, etc. Though still a new entry, the company has made over 21 investments in different companies.

25. Accel Partners

Founded in 1983, Accel Partners has offices in Palo Alto and San Francisco, with others in London, China, and India. Accel invests in startups in seed, early, and growth stages, and it focuses on different areas, such as FinTech, cloud/SaaS, enterprise IT, security, consumer, and media.

The firm is best known for its early bet on Facebook. Some of the notable deals it has participated in include Slack’s Series E fund, Flipkart’s Series G round, and Olacabs’ Series E round. It has also invested in Deliveroo, Freshdesk, Birchbox, etc. Accel Partners makes investments ranging from $1m to over $100m.

Final takeaways

Whether you’re starting a new B2B business, SaaS product, or expanding your market, venture capital can be highly beneficial in providing funds for your operations. Keep in mind that you’ll need to give the VC firm a stake in your company.

While there are individual investors and banks that can offer capital, working with VC firms seem a great option because they provide mentorship and access to tools you’ll need to grow your company. Plus, some VCs are area-specific. For example, you can get a VC firm that only invests in SaaS and cloud companies because they have experience and knowledge in that area. Whichever you choose, ensure you do thorough research to pick the right fit for your business.

If you’re looking for venture capital, whether at the early- or growth-stage, take the time to develop a compelling product and a well-structured business plan. These are essential elements for new companies, especially when pitching to VC firms. However, as you grow, VC firms will likely approach you with different offers. Meanwhile, we hope this list has provided you with some great firms to approach for funding.

If you’re a B2B founder interested in growing a company that’s attractive to VC firms and investors, be sure to reach out to us today. Gripped is passionate about helping sales leaders, marketing teams, and founders create a robust presence that attracts customers as well as investors.